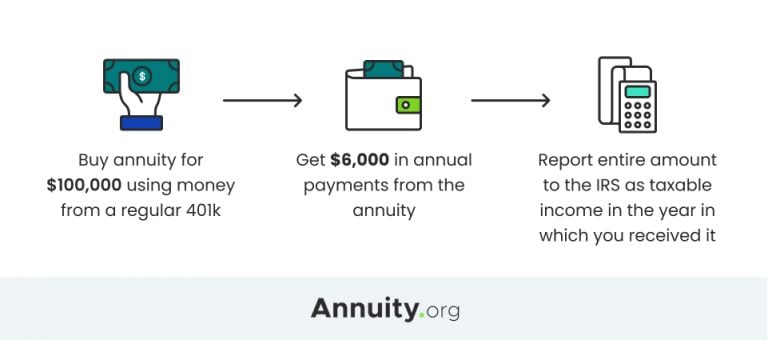

Annuity payments are subject to tax based on how the annuity was funded. If your annuity was funded with pre-tax dollars, typically seen in qualified plans, the entire amount of the withdrawals or payments you receive is taxable as income. Conversely, if your annuity was purchased with post-tax dollars, as with nonqualified plans, you are only taxed on the earnings portion of the withdrawals.

Jennifer Schell, CAS® Financial Writer, Certified Annuity Specialist® Jennifer Schell is a professional writer focused on demystifying annuities and other financial topics including banking, financial advising and insurance. She is proud to be a member of the National Association for Fixed Annuities (NAFA) as well as the National Association of Insurance and Financial Advisors (NAIFA). Read More

Savannah Pittle Senior Financial Editor Savannah Pittle is an accomplished writer, editor and content marketer. She joined Annuity.org as a financial editor in 2021 and uses her passion for educating readers on complex topics to guide visitors toward the path of financial literacy. Read More

John Stevenson, CFF Owner and Advisor at Stevenson Retirement Solutions John Stevenson, a Certified Financial Fiduciary®️, specializes in securing retirements with tax-free accounts. With a focus on guaranteed retirement, he's ensured none of his clients suffer from market fluctuations. As a renowned educator and podcast host, John empowers thousands weekly, sharing his expertise in minimizing taxes and protecting against financial downturns. Read More

Fact Checked Fact CheckedAnnuity.org partners with outside experts to ensure we are providing accurate financial content.

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

How to Cite Annuity.org's ArticleAPA Annuity.org (2024, August 7). Annuity Taxation: Implications and Strategies. Retrieved September 6, 2024, from https://www.annuity.org/annuities/taxation/

MLA "Annuity Taxation: Implications and Strategies." Annuity.org, 7 Aug 2024, https://www.annuity.org/annuities/taxation/.

Chicago Annuity.org. "Annuity Taxation: Implications and Strategies." Last modified August 7, 2024. https://www.annuity.org/annuities/taxation/.

Why Trust Annuity.org Why You Can Trust Annuity.orgAnnuity.org has provided reliable, accurate financial information to consumers since 2013. We adhere to ethical journalism practices, including presenting honest, unbiased information that follows Associated Press style guidelines and reporting facts from reliable, attributed sources. Our objective is to deliver the most comprehensive explanation of annuities and financial literacy topics using plain, straightforward language.

We pride ourselves on partnering with professionals like those from Senior Market Sales (SMS) — a market leader with over 30 years of experience in the insurance industry — who offer personalized retirement solutions for consumers across the country. Our relationships with partners including SMS and Insuractive, the company’s consumer-facing branch, allow us to facilitate the sale of annuities and other retirement-oriented financial products to consumers who are looking to purchase safe and reliable solutions to fill gaps in their retirement income. We are compensated when we produce legitimate inquiries, and that compensation helps make Annuity.org an even stronger resource for our audience. We may also, at times, sell lead data to partners in our network in order to best connect consumers to the information they request. Readers are in no way obligated to use our partners’ services to access the free resources on Annuity.org.

Annuity.org carefully selects partners who share a common goal of educating consumers and helping them select the most appropriate product for their unique financial and lifestyle goals. Our network of advisors will never recommend products that are not right for the consumer, nor will Annuity.org. Additionally, Annuity.org operates independently of its partners and has complete editorial control over the information we publish.

Our vision is to provide users with the highest quality information possible about their financial options and empower them to make informed decisions based on their unique needs.

One of the biggest benefits of annuities is their ability to grow on a tax-deferred basis. This includes dividends, interest and capital gains, all of which may be fully reinvested while they remain in the annuity.

Your investment grows without being reduced by tax payments, but that doesn’t mean annuities are a way to avoid taxes completely. Annuities are subject to taxation, and how they are taxed depends on various factors.

“When you take distributions or withdraw from the annuity later in retirement, you will be taxed on the growth at your then-current tax rate,” explained annuity and retirement expert Paul Tyler.

Because of the complexity, it’s best to consult with a tax professional when purchasing an annuity and before withdrawing any funds.

John Stevenson, CFF Owner and Advisor at Stevenson Retirement SolutionsA popular strategy for generating tax-free income from an annuity is through a Roth Conversion. My clients frequently buy an annuity within a traditional IRA and subsequently opt to convert it to a Roth before initiating their income stream. This approach enables them to capitalize on the contractual guarantees without incurring a lifetime of taxes on their annuity income.

John Stevenson, a Certified Financial Fiduciary®️, specializes in securing retirements with tax-free accounts. With a focus on guaranteed retirement, he’s ensured none of his clients suffer from market fluctuations. As a renowned educator and podcast host, John empowers thousands weekly, sharing his expertise in minimizing taxes and protecting against financial downturns.

The tax treatment of an annuity is determined by the type of annuity, the source of funds — meaning whether it is held in a qualified or non-qualified account — and the purpose of the annuity.

Annuities are classified as either qualified or non-qualified.

Qualified annuities are funded with pre-tax dollars, typically through an employer-sponsored retirement plan like a 401(k) or an IRA. Contributions to these annuities are tax-deferred, meaning taxes are paid when withdrawals are made.

Non-qualified annuities, on the other hand, are funded with after-tax dollars. As such, they require tax payments only on the earnings portion at withdrawal.

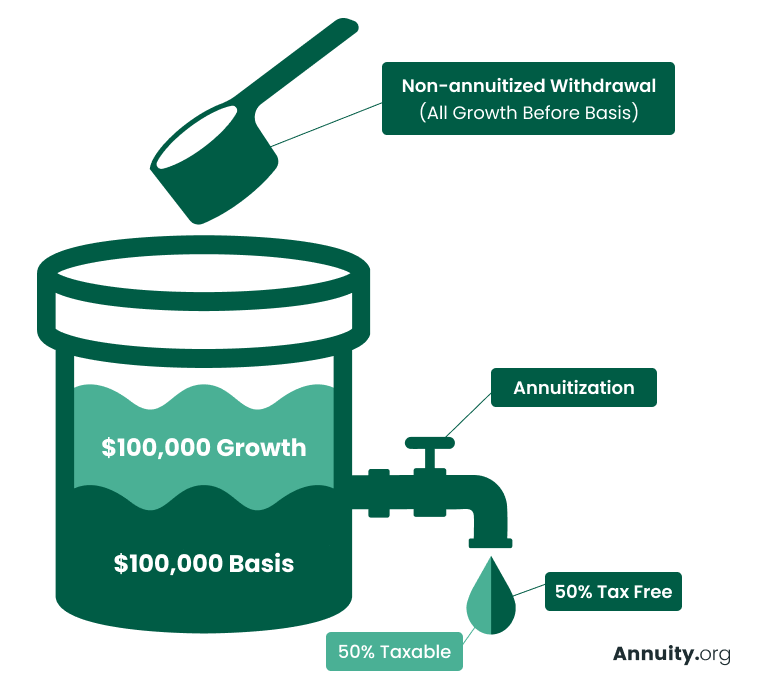

The exclusion ratio is used to determine what percentage of non-qualified annuity income is taxable. Essentially, this entails segregating the annuity payments into a principal component (not taxable) and an earnings component (taxable).

Did You Know?The exclusion ratio takes into account the principal that was used to purchase the annuity, the amount of time the annuity has been paying, the interest earnings and the annuitant’s life expectancy.

If an annuitant lives longer than his or her actuarial life expectancy, any annuity payments received after that age are fully taxable. That’s because the exclusion ratio is calculated to spread principal withdrawals over the annuitant’s life expectancy. Once all the principal has been accounted for, any remaining income payments or withdrawals are considered to be from earnings.

Exclusion Ratio Example

Calculate Your Annuity Payout Instantly

Get the most accurate estimate with our calculator’s real-time annuity product data.How and when you withdraw funds from your annuity also affects your tax bill.

In general, if you withdraw money from your annuity before you turn 59 ½, you may owe a 10% penalty on the taxable portion of the withdrawal.

After that age, taking your withdrawal as a lump sum rather than an income stream will trigger the tax on your earnings. You’ll have to pay income taxes that year on the entire taxable portion of the funds.

Did You Know?Withdrawals and lump-sum distributions from annuities are taxed as ordinary income. They do not receive the benefit of being taxed as capital gains.

Regardless of how you withdraw the money, the tax status of the contract determines how much of the withdrawal will be taxed. If it’s a qualified annuity, you will pay taxes on the full withdrawal amount. If it is non-qualified, you will pay income taxes on the earnings only.

Non-qualified annuity withdrawals use last-in-first-out (LIFO) tax rules, which dictate that earnings are taxed first. Consequently, tax liability tends to be higher in the early years of annuity ownership. Once the amount withdrawn exceeds the amount of earnings, subsequent withdrawal amounts are considered a tax-exempt return on your principal.

For example, if you invested $100,000 in an annuity that grew to $150,000, your gains would be $50,000. If you then began making withdrawals from that annuity after age 59 ½, all withdrawn funds up to $50,000 would be subject to income tax.

Since it would be considered a return on your principal, you wouldn’t have to pay taxes on any amount withdrawn after that $50,000.

According to the General Rule for Pensions and Annuities by the IRS, each annuity income payment from a non-qualified plan is made up of two parts. The tax-free part is considered the return of your net cost for purchasing the annuity. The rest is the taxable balance or the earnings.

When you receive income payments from your annuity as opposed to withdrawals, the idea is to divide the principal amount — and its tax exclusions — evenly out over the expected number of payments. The rest of the amount in each payment is considered earnings subject to income taxes.